Save on Additional Buyer's Stamp Duty (ABSD) Using Decoupling & Part-Purchase

- Vivian Chong

- May 18, 2020

- 6 min read

Updated: Jan 13, 2024

We are officially 1 month and 12 days into our Circuit Breaker Period. Hope everyone is coping well!

I think we are getting used to it. Working from home. Staying at home.

There is time for us to finally discover the hidden culinary skills within us. There is also time for us to revisit the good old board games that have seen dust accumulating.

Lesser quarrels, fewer fights. We are starting to learn how to live 24/7 with one another without stepping onto the toes of our family members :)

It is all about adapting to changes.

"The art of life is a constant readjustment to our surroundings." Kakuzo Okakaura

Today I am excited to share a case which I did recently.

My clients wanted to invest in a 2nd property. I managed to help them save 12% ABSD (kindly note that the latest ABSD for Singaporean buying their 2nd property is 17%) by using the Decoupling and Part-Purchase Method. I also managed to get them a property with good rental yield and huge upside potential!

Check it out!

Background To The Case

Mr and Mrs Lim jointly own a condominium in Bishan Loft which was bought more than 10 years ago. Both of them are Singaporeans. As their income have both increased over the years, they would now like to buy another property for investment purpose.

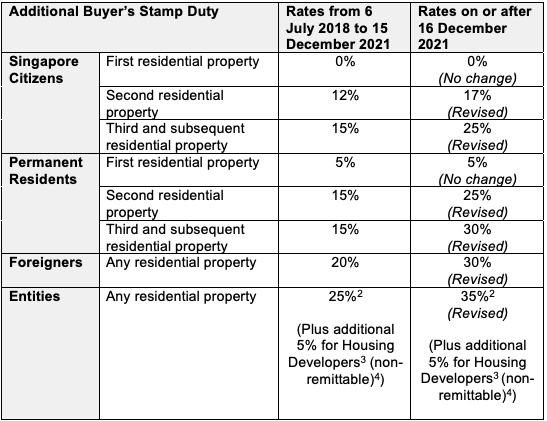

One of the cooling measures introduced in July 2018 was increasing the Additional Buyer's Stamp Duty (ABSD) to 12% for Singaporeans who are buying 2nd residential property. This is an increased from the previous 7%. (*Please note that the latest ABSD is 17%).

To see if I can help Mr & Mrs Lim save on the ABSD, I gathered some information from them and do an evaluation on their situation.

Decoupling and Part-Purchase Method

What is Decoupling and Part-Purchase? This essentially involves removing the ownership of one spouse from the first property. In that way, he or she can buy a new property without paying ABSD.

Below are the information needed for this process.

Property Information:

- Outstanding Mortgage Loan = $210,000

- Valuation of Existing Property = $1,300,000

Mr Lim:

- CPF Used + Accrued Interest (Mr Lim) = $250,000

- CPF Ordinary Account Balance (Mr Lim) = $150,000

- In-Principal Approval for Mortgage Loan (1st Mortgage Loan) = Up To $2million

Mrs Lim:

- CPF Used + Accrued Interest (Mrs Lim) = $190,000

- CPF Ordinary Account Balance (Mrs Lim) = $230,000

- In-Principal Approval for Mortgage Loan (1st Mortgage Loan) = Up To $1.5million

It is important to do a careful calculation on the amount to be returned to CPF before proceeding with Decoupling and Part-Purchase. I will also make it a point to do an In-Principal Approval for the mortgage loan amount clients can take to make sure this process can be completed smoothly.

After evaluating and doing the necessary checks, Mr & Mrs Lim made the decision to remove Mr Lim's name from Bishan Loft so they can buy another property under his name.

Action To Take

We need to engage 2 lawyers to represent Mr & Mrs Lim respectively with the Decoupling and Part-Purchase Procedure. The following are what needs to be done.

Mr Lim:

- Sell 50% of his share in Bishan Loft to Mrs Lim (Selling Price = $650,000, as the valuation of the property is $1,300,000)

- Pay off 50% of outstanding loan = $105,000

- Return CPF Used + Accrued Interest = $250,000

- Cash Proceeds = $295,000

Mrs Lim:

- Refinance her 50% share of the outstanding loan to a new bank, and at the same time take up another loan to purchase Mr Lim's share.

- Financial Breakdown for purchasing Mr Lim's share:

* Purchase Price = $650,000

* 5% Deposit in Cash = $32,500

* 20% CPF = $130,000

* 75% Loan = $487,500

- New Loan for Bishan Loft = $105,000 + $487,500 = $592,500

Costs Involved:

- Buyer's Stamp Duty = $14,100

- Legal Fees (2 lawyers to represent Mr Lim and Mrs Lim respectively) = $5.500

Mrs Lim can choose to pay the above costs using her CPF as she has sufficient CPF in her OA.

On Completion Day of Part-Purchase

Bank will disburse $592,500 as follows:

- $210,000 to redeem existing bank loan

- $250,000 to Mr Lim's CPF account

- $132,500 to Mr Lim as cash proceed

Mr Lim will receive his cash proceed in the following breakdown:

- $130,000 released from Mrs Lim CPF OA

- $132,500 from bank loan

- $32,500 from the deposit that Mrs Lim paid

Purchase of next property without ABSD

We proceed to the next stage, which is the sourcing of next property to buy.

Mr & Mrs Lim is very clear on the objectives they want to achieve with the next property. It is purely for investment and they have no intention to live there. Location does not matter but it must have upside potential and can be rented out easily.

They set their budget at $1.5m.

With these in mind, I did a thorough search on the units that fulfil the requirements. These include those in CCR, RCR and OCR. I search from both the resale market as well as primary market (ie. new homes direct from developer). Finally I shortlisted the units that are most suitable.

After looking through the information, photos and videos of the units, Mr & Mrs Lim narrowed down to 5 units for viewing. These are Newton 18, Trevista, Gem Residences, Paya Lebar Residences and Bedok Residences.

Out of the units we viewed, the one which stood out is Gem Residences. Gem Residences is located in Toa Payoh. This is a mature estate with excellent connectivity and amenities. It is within walking distance to Braddell MRT station, thus making it attractive to tenants who do not drive.

Also, Gem Residences have a novel "Club-Condo" concept. It ties up with various service providers to offer on-demand services like grocery delivery, car rental, housekeeping and concierge services. This will be a draw to tenants when it is TOP.

The supply of new condominium units in Toa Payoh is low. There are no new condominiums there, with the last being Trevista which was TOP in 2011. With the low supply and good location, the potential upside to Gem Residences is huge.

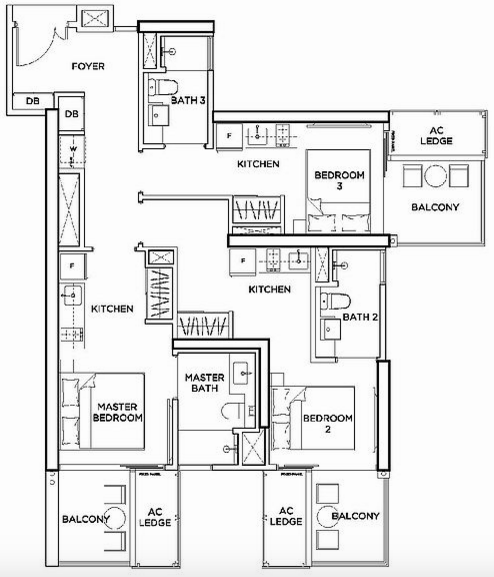

There is a very unique 3 bedrooms type in Gem Residences, which is called Trios. This is a Triple-Keys unit - the unit opens to 3 studios with attached bathroom. I was attracted to this layout because the rental yield to rent 3 units of studio will be higher than a typical 3 bedroom unit.

After some discussion, Mr & Mrs Lim decide to go for the Trios unit in Gem Residences. It was not a difficult decision to make as the unit fulfils all their requirements.

Great Rental Yield

Fast forward 2 years later, Gem Residences has just received TOP this year and Mr & Mrs Lim collected the keys to their unit.

The 3 studios were quickly taken up within a month, and the rental yield is more than 4%. This is higher than the typical rental yield of 2% to 3% for residential properties in Singapore!

I am monitoring the market and the prices of Gem Residences. In time to come after Mr & Mrs Lim fulfilled the 3 years period so that they do not need to pay Seller Stamp Duty (SSD), I will advise them to sell and cash out.

Meanwhile, just enjoy being a Landlord!

Conclusion

I am extremely happy to have achieved what Mr & Mrs Lim set out to achieve when they decide to purchase a 2nd property. Not only did I manage to help them save 12% ABSD, I also help them secure a unit with huge potential upside and good rental returns.

If you would also like to explore purchasing a 2nd property and saving on 12% ABSD, please feel free to contact me or make an appointment via the link below.

Hope to see you soon!

Related Reading

About The Author

Vivian is a highly experienced real estate agent who has been in the industry for 18 years.

Over the years, she has transacted numerous property deals including HDB and private properties. She is well-versed in policies and regulations involving the sale and purchase of residential properties. She has also handled many transactions involving complicated situations like contra, divorce, administration / probate cases, and decoupling / part-share purchase.

Vivian is also a mother to 2 boys. Being a real estate mom allows her to spend more time with her children as they were growing up. Both boys are avid footballers representing their schools and clubs. She loves watching their games and hardly miss a game whenever they play.

Vivian is an active real estate salesperson and team leader. Call her at 98577714 for your real estate matters, or if you are looking to join the real estate industry.

%20copy.png)